Cybercriminals have a lot of opportunities to commit fraud in the banking and financial sector because of the various security gaps. A common tactic fraudsters use to claim they transferred money and email a manipulated screenshot of the receipt, leading the victim to assume the transfer was successful.

Also, claim that they sent more than they received in a transfer and demand a refund of the difference when, in reality, this is just another tactic they use to steal from their victims.

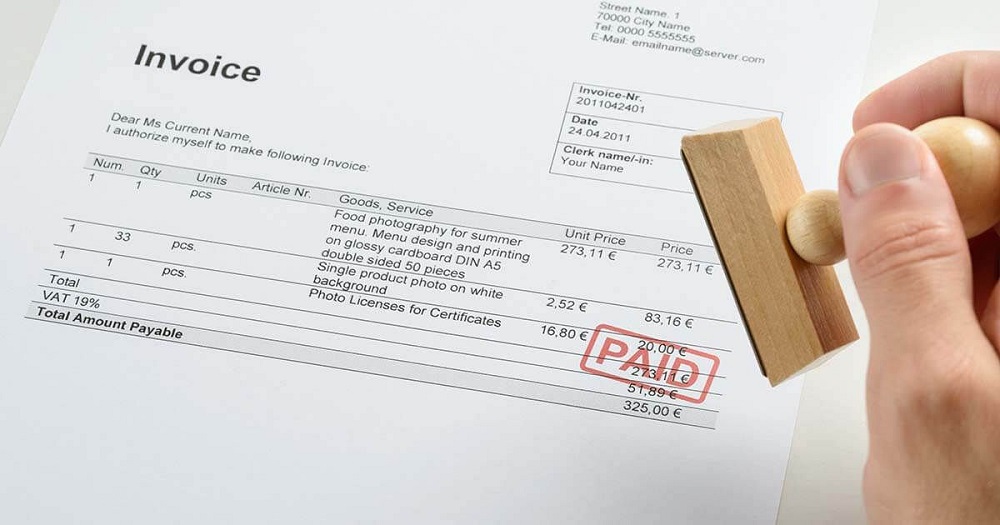

Signs Of A Fake Slip Transfer Receipt:

- The fonts are unclear and inconsistent

- Unorganized page layouts

- There’s something off about the text color; it’s a fading slip

Nonetheless, despite the tidy font, layout, and text colors, you should be cautious. They may be highly skilled con artists. To check fake transfer slip (เช็ค สลิป โอน เงิน, which is the term in Thai), please consider the following safety measures.

Tips To Safe From Fake Slip Transfer Scam

· Check Your Bank Statement To Double-Check The Receipt.

Always double-check your bank statement to be sure you got the money. Whenever you get an additional sum of cash alongside an incoming transfer, you can rest assured that the transaction is legitimate. If the incoming transaction doesn’t show up on your account statement, it’s a good idea to ask the sender.

· Examine The Sample Money Transfer Slips, Letters, And Numerical Accuracy.

You should not blindly believe a mobile payment or fund transfer receipt confirming the payment, especially if you notice something that seems off.

Simple methods for detecting fake slip transfer (สลิปปลอม, which is the term in Thai) check the details about the transfer, such as the time, date, amount, and account holder’s name on the slip. If you examine closely, you can notice that the thickness of the notes on the receipt varies.

· Examine The QR Code On The Slip.

To detect fake e-Slips and other forms of electronic money transfer slips, various banking apps will include a QR Code. It is a simple method for writing out checks, and you can make wire transfers to banks using their website.

Finale Takeaway

If you have fallen victim to this scam or need help verifying your account balance or bank statements, you should call the bank authority. Nowadays, one can get trapped in various fake slip transfer scams. Maintaining vigilance and preventing complacency in such situations is essential to avoid falling prey to scammers.

Comments